This Top Canadian Stock Could Hike Its Dividend by 30%

If you’re a dividend growth investor, nothing makes you happier than a company ramping up dividend growth and increasing your passive income stream.

Fortunately for those looking to buy Canadian dividend stocks, this Big 5 Canadian bank has publicly stated the company has significant room to grow the dividend.

That company is The Royal Bank of Canada (TSE:RY).

What’s going on with The Royal Bank’s (TSE:RY) dividend?

Well, nothing really.

That’s because the OSFI placed strict regulations on some of the top Canadian stocks in the financial sector. Those restrictions were that companies were still allowed to pay a dividend, but couldn’t raise that dividend.

They did this to preserve liquidity and make sure that Canada’s financial institutions were well equipped to navigate the pandemic. It turns out that precautions were over and above, and most of Canada’s big banks, particularly the Royal Bank of Canada, are flush with cash.

Strong cash positions will lead to large dividend growth, and maybe more

I will admit, the idea of this first came to me from an excellent Globe and Mail article, which you can read here.

But the premise is that the Royal Bank’s payout ratio has historically hovered around the 50% range. If we look forward to estimated 2021 profits of $10.58 per share, the company’s dividend, if it followed historical numbers in terms of payout ratios, would be around $5.30.

At this point in time, the company pays a $4.32 dividend on an annual basis. So, in order to return to historical numbers in terms of dividend payouts, the company would need to raise its dividend by nearly 25%.

For a company with typical dividend growth in the mid to high single digit range (6.85% annually over the last 5 years) this would signal nearly 4X the average annual dividend growth that investors are used to seeing from the Royal Bank over the last half decade.

And again, that increase would only be to get it back to what it typically pays out in terms of earnings.

Although this is nice to think about, it’s not the best allocation of capital

The fact that Royal Bank could do this is huge. It shows the strength of the company and the bullish forward outlook for Canadian banks and financial institutions in general.

And yes, this type of dividend growth is dreamy to think about, especially if you’re an avid dividend growth investor.

However, it’s just not going to happen.

Royal Bank is unlikely to ramp its dividend up 25% in a single year. Instead, in my opinion it would be optimal for the company to deploy excess capital and profits towards acquisitions.

As I mentioned prior, RBC has typically raised the dividend by 6.25% annually over the last 5 years. Maybe we see that dividend growth accelerated to 9% annually, and the company puts excess capital to work in acquiring more companies to boost the bottom line.

What this in turn does is allows the company to maybe keep growing the dividend at that accelerated pace for a longer period of time, resulting in compounding dividend growth for investors over the next 5-10 years, instead of a one-off hike of 25-30%.

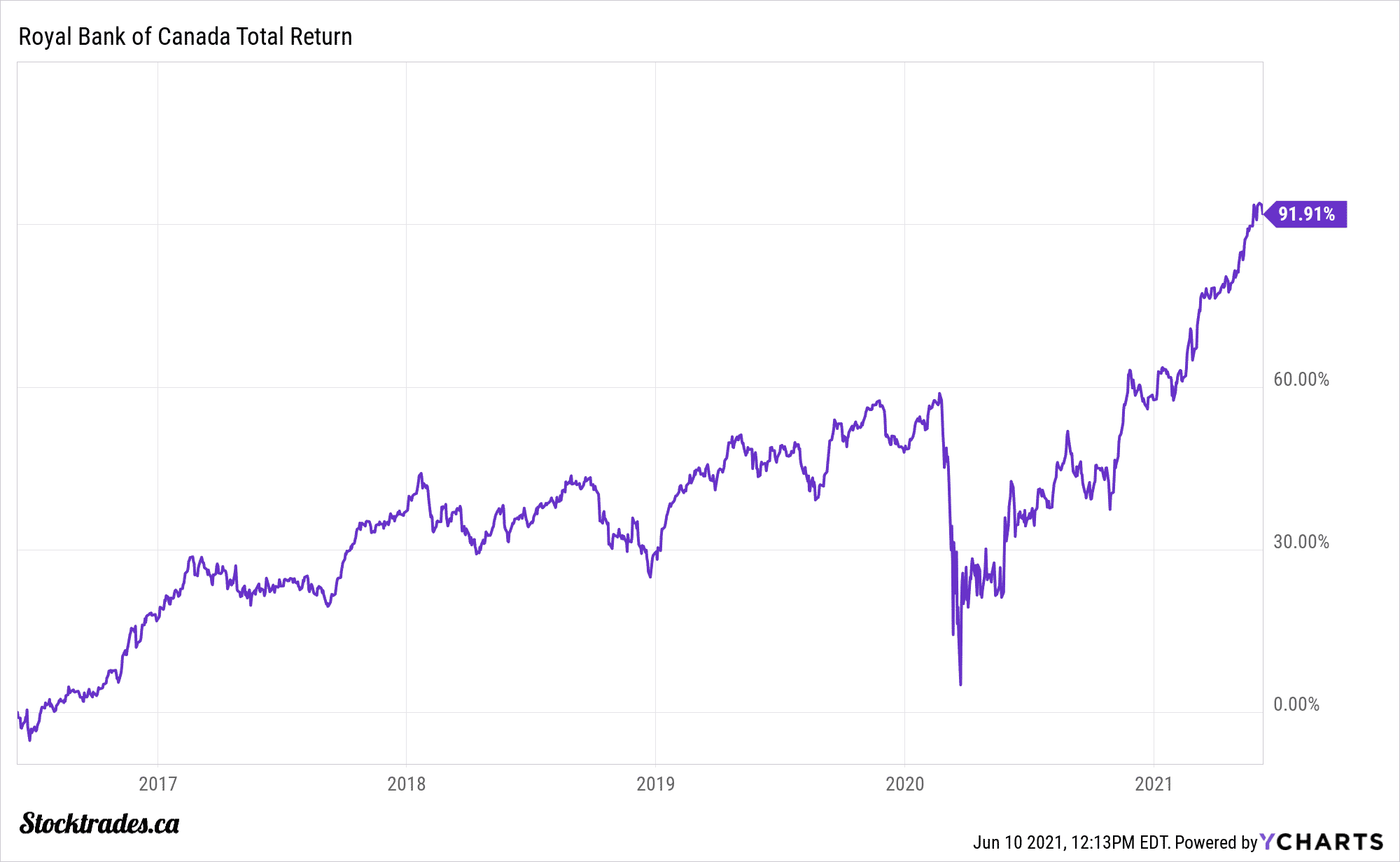

Royal Bank (TSE:RY) 5 year total return

Overall, financial companies are in a great position moving forward

Although I highlighted the Royal Bank in this article, primarily because of the commentary inside of the Globe and Mail piece, most all Canadian banks are in a similar position.

Many doubted Canadian financial companies, whether they be Big Banks or major insurers over the course of the pandemic. Mortgage deferrals, loan defaults, job losses. All key factors were going to lead to the inevitable demise of Canada’s financial institutions.

However, much like 2008, they’ve proven everyone wrong. The ability for most to navigate the pandemic flush with cash and in strong financial positions will allow them to benefit significantly from the rising interest rate environment we’re no doubt going to see in 2022 and beyond.

Want to see a bit on smaller Canadian banks? See our Part 2 on Canadian bank earnings covering some of the smaller banks.

Do we think Royal Bank is the best opportunity of them all? We cover most all of the major financial institutions here in Canada over at Stocktrades Premium, and release our best picks to thousands of Premium members. Take a look at what we offer here.