This Top Canadian Stock Has Made Investors a LOT of Money This Year

Key takeaways

Strong sales and earnings growth driving massive near-term momentum

Margins lead the story, but the company might be expanding too fast, too soon

Expansion into the U.S. is promising but execution heavy

3 stocks I like better than Group DynamiteCanadian investors know the struggle. You scan the TSX looking for growth, and it often feels like you’re choosing between slower growing banks or volatile energy plays. Finding a genuine consumer growth story that hasn’t already left the station is tough.

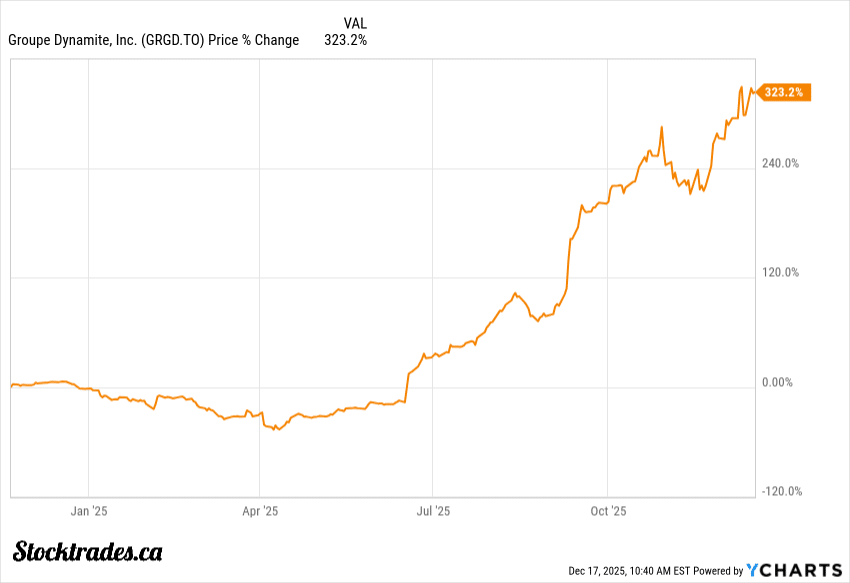

Groupe Dynamite (GRGD.TO) has recently exploded onto the scene, quite literally. The stock has surged following a quarter that, frankly, blew the doors off expectations, and it’s up more than 330% since its IPO last year.

But if you’re like me, you’re probably asking: “Did I miss the boat, or does this company still have room to run?”

In this article, I want to unpack the numbers behind the hype, look at the very real risks lurking in the valuation, and help you decide if this retailer deserves a spot in your portfolio.

Exceptional Same‑Store Sales Drives Momentum

Most retailers are fighting tooth and nail just to keep sales flat in this economy. Look no further than companies like Lululemon and Nike.

However, Groupe Dynamite seems to be operating in a completely different reality.

In Q3 2025, comparable sales jumped a substantial 31.6%. To put that in perspective, anything above 5% is usually considered a win in fashion retail. This wasn’t just a fluke either; it’s an acceleration from the 28.6% growth they posted in Q2.

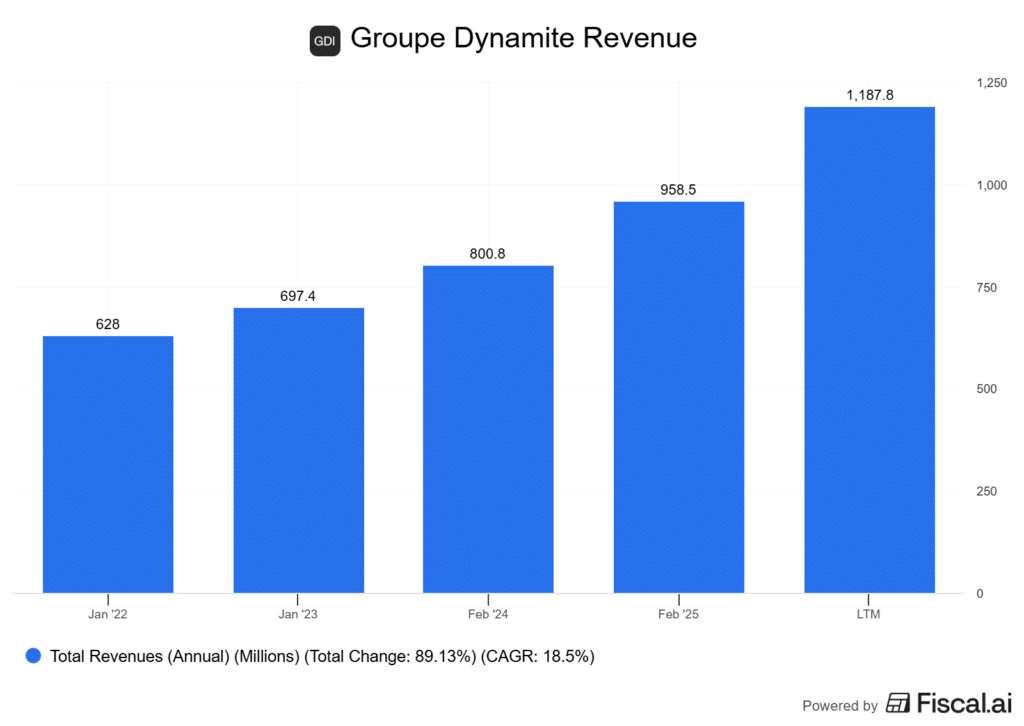

Total revenue climbed 40.3% to $363 million. While opening eight new Garage stores in the U.S. certainly helped, organic growth did the heavy lifting here.

When same-store sales drive the bulk of your revenue gain, it tells you the brands heat is real. People aren’t just buying because there are more stores; they are buying because they want the product.

Online sales also saw a healthy tailwind, rising 43.3% to $63.2 million. This suggests to me that their digital strategy is complementing the brick-and-mortar experience rather than cannibalizing it. This is a critical balance for modern retail, and one that many companies fail at.

Simply put, the company is firing on all cylinders. But as we know, retail is fickle, and maintaining this velocity is a massive challenge. Most retail investors end up buying the top and getting subsequently wrecked.

Margins Are Strong, But Likely Temporary

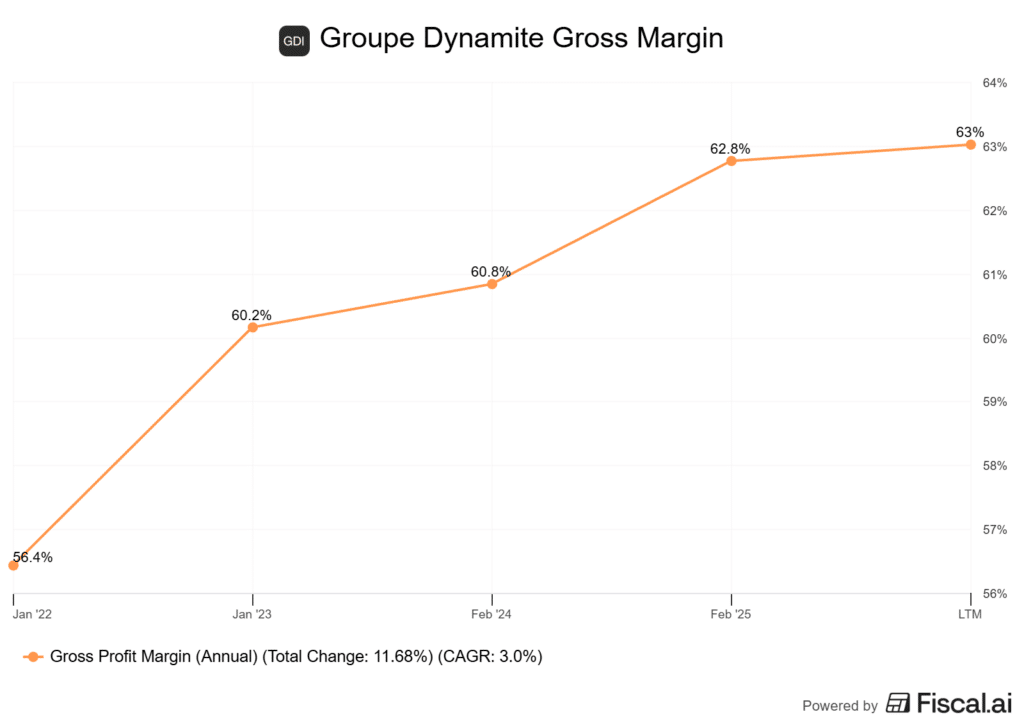

Groupe Dynamite isn’t just selling more clothes; they are keeping more of every dollar they earn with the expansion of gross margins. Gross margins hit 66.1% in the quarter, the strongest level in three years.

I’m interested to see if this number holds throughout future quarters. If it does, this is one of the higher margin fashion retailers I’ve seen in years.

This drove operating income to nearly double, hitting $120.1 million. Even more impressive, their adjusted EBITDA margin expanded to 40.2%. For a mid-market apparel retailer, these margins are incredibly high.

However, this is where my “defensive optimist” nature kicks in.

Management themselves acknowledged that margins near 40% are difficult to sustain long-term. They have benefited from easing tariff volatility and tight inventory management, but these are variable factors.

The company also declared a $2.30 per share special dividend. While I love seeing cash returned to shareholders, it’s important to view this as a sign of current balance sheet strength, not a recurring yield you can retire on. It’s a nice bonus, but don’t anchor your thesis on it happening every year.

If cost pressures rise, whether through wages, rent, or new tariffs, that 40% EBITDA margin could compress quickly. I believe investors need to watch this metric like a hawk in 2026.

The U.S. Expansion: High Reward, High Risk

The growth story for Groupe Dynamite relies heavily on its ability to export its success south of the border. They are aggressively expanding the Garage banner in the U.S., targeting “investment grade” malls (Tier 1 and 2 locations).

The logic is sound. The U.S. market is a plethora of opportunity compared to Canada. But it is also a graveyard for Canadian retailers who tried to scale too fast.

Expanding into premium U.S. real estate comes with substantial costs. Rent is higher, competition is fiercer, and the American consumer is ruthless with brands that lose their edge.

So far, the execution has been flawless. But as they scale, SG&A expenses will naturally climb. We saw SG&A hit roughly $96 million this quarter. While it decreased as a percentage of sales, the absolute dollar amount is rising.

The snag? If sales growth slows even slightly, those fixed costs for premium U.S. locations will weigh heavily on the bottom line.

In addition to this, I don’t like the idea of the company expanding into the UK. Conquer the US market, which is plenty big enough, prior to expanding elsewhere. You risk thinning yourself out and performing “average” everywhere instead of outstanding in one particular area.

Valuation: Priced for Execution

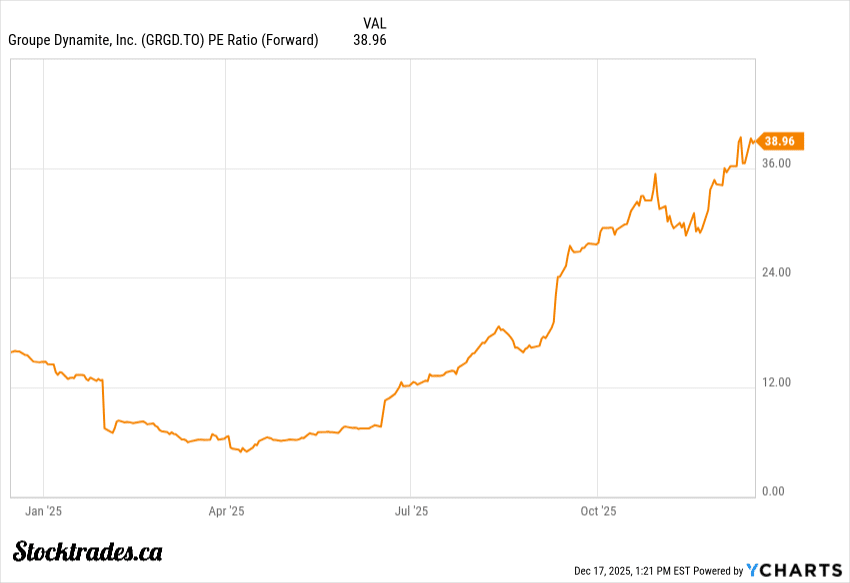

Here is the hard truth: Groupe Dynamite is priced for perfection.

Trading at a premium multiple significantly above peers like Aritzia or American Eagle, the market has already baked in a lot of future success. When a stock is priced this high, any earnings miss or guidance cut can lead to a sharp correction.

You are paying for the expectation that they will continue to execute flawlessly on their U.S. expansion and maintain industry-leading margins, along with navigate the UK expansion next year (if they pull the trigger on that).

Is it impossible? No. But the margin of safety here is slim. Trends change fast. If they miss a season, that 31% comp growth can turn negative very quickly.

The Bottom Line

Groupe Dynamite is undeniably one of the most exciting growth stories on the TSX right now. The numbers are spectacular, the brand heat is undeniable, and the management team is executing well.

However, as a GARP investor, even I struggle with the current price tag.

If you are a growth-focused investor with a higher risk tolerance, GRGD could be a small “satellite” position in your portfolio to capture that U.S. expansion upside. But for the core of a conservative portfolio, the valuation feels a bit stretched.

I would personally wait for a pullback or a general market dip to start a position. The company is fantastic; I just want to buy it at a price that offers a bit more safety.