These Canadian ETFs Offer Easy Access to Diversification and Several Global Powerhouses

Key takeaways Low-Cost U.S. & Global Access – Enable Canadian investors to gain cost-effective access to international markets. Broad Market Coverage – These…

Key takeaways Low-Cost U.S. & Global Access – Enable Canadian investors to gain cost-effective access to international markets. Broad Market Coverage – These…

Key takeaways Diversified Yield Options – These ETFs provide exposure to Canadian (and some U.S.) preferred shares, offering an attractive income stream. Rate…

Key takeaways Enhanced Income Generation – All these ETFs utilize covered call strategies to generate additional income over dividends, making them attractive for…

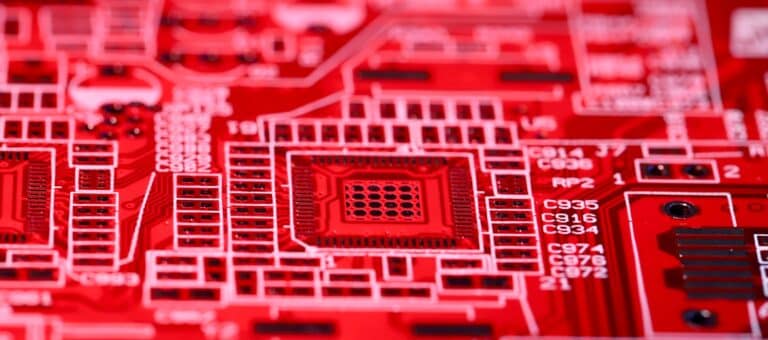

Key takeaways Semiconductors Drive Innovation – These ETFs offer exposure to the backbone of modern technology, from AI to 5G and cloud computing….

Key takeaways Diversified Real Estate Exposure – Each ETF provides broad exposure to the Canadian real estate sector, including retail, industrial, and residential…

Key takeaways Gold as a Safe Haven – These ETFs provide exposure to gold, a traditional hedge against inflation and economic uncertainty. Diverse…

Key takeaways Broad Market Exposure at Low Cost – These ETFs provide diversified access to Canadian and U.S. stock markets with low expense…

Key takeaways Different Fee Structures & Strategies – Some ETFs reinvest income for tax efficiency, while others distribute monthly interest. Low-Risk, High Liquidity…

Key takeaways Customization for Risk Tolerance – Ranging from all-equity to conservative balanced options, these ETFs cater to different investor risk preferences. All-in-One…

Key takeaways Volatility and Long-Term Potential – While blockchain ETFs can be volatile, they also present strong long-term growth opportunities as blockchain adoption…